All Categories

Featured

Table of Contents

No-load Multi-Year Assured Annuities (MYGAs) on the RetireOne system offer RIAs and their clients defense against losses with an assured, repaired price of return. These options are interest-rate sensitive, however might provide insurance attributes, and tax-deferred growth. They are favored by traditional capitalists looking for rather foreseeable end results.

3 The Cash Out Option is an optional feature that should be chosen at contract problem and subject to Internal Revenue Code restrictions. Not readily available for a Qualified Longevity Annuity Contract (QLAC).

An annuity is a contract in which an insurance company makes a series of earnings repayments at normal intervals in return for a costs or costs you have actually paid. Annuities are commonly purchased for future retired life income. Only an annuity can pay an income that can be guaranteed to last as long as you live.

Annuity Group

The most typical kinds of annuities are: single or several premiums, instant or postponed, and dealt with or variable. For a single premium contract, you pay the insurer just one payment, whereas you make a collection of payments for a multiple costs. With an instant annuity, earnings payments begin no behind one year after you pay the premium.

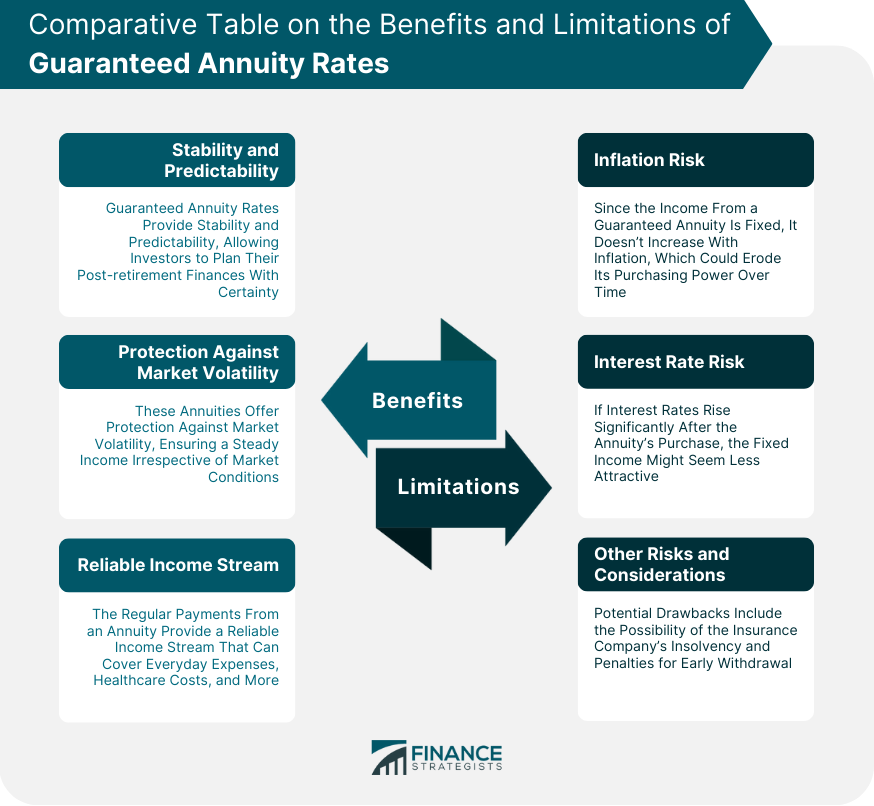

The existing rate is the price the firm determines to credit rating to your contract at a specific time. The minimum guaranteed interest rate is the most affordable rate your annuity will gain.

Some annuity agreements apply various rate of interest rates to each premium you pay or to costs you pay during various time durations. Various other annuity agreements might have two or even more built up values that money different benefit choices.

Under present government law, annuities receive unique tax obligation therapy. Revenue tax on annuities is deferred, which indicates you are not tired on the passion your money earns while it remains in the annuity. Tax-deferred build-up is not the exact same as tax-free accumulation. An advantage of tax-deferral is that the tax brace you are in when you get annuity earnings settlements might be lower than the one you are in during the accumulation period.

A lot of states' tax regulations on annuities comply with the government law. You should speak with a professional tax consultant to review your specific tax circumstance. Many states have laws that give you a set number of days to look at the annuity agreement after you acquire it. If you determine during that time that you do not want the annuity, you can return the agreement and obtain all your money back.

The "totally free appearance" duration need to be plainly stated in your contract. Make certain to read your contract meticulously during the "cost-free look" period. You must consider what your objectives are for the money you place into any kind of annuity. You require to believe concerning just how much danger you agree to take with the cash also.

401k Annuity Option

Terms and problems of each annuity contract will certainly vary (who has the best annuities). Contrast information for similar contracts from numerous business. If you have a certain concern or can not get answers you require from the representative or business, speak to the Department.

The buyer is often the annuitant and the individual to whom regular repayments are made. There are two standard type of annuity contracts: immediate and postponed. An instant annuity is an annuity agreement in which payments begin within 12 months of the day of acquisition. The immediate annuity is bought with a solitary costs and periodic repayments are generally equal and made regular monthly, quarterly, semi-annually or every year.

Routine payments are postponed until a maturation date mentioned in the agreement or, if earlier, a day chosen by the proprietor of the agreement. top annuity insurance companies. The most common Immediate Annuity Agreement payment alternatives consist of: Insurance provider makes routine payments for the annuitant's lifetime. A choice based upon the annuitant's survival is called a life contingent alternative

There are 2 annuitants (called joint annuitants), usually spouses and periodic settlements continue till the fatality of both. The earnings settlement quantity may continue at 100% when only one annuitant lives or be lowered (50%, 66.67%, 75%) during the life of the making it through annuitant. Periodic payments are created a specific amount of time (e.g., 5, 10 or twenty years).

Life Annuities Rates

Some prompt annuities provide rising cost of living protection with regular increases based upon a fixed price (3%) or an index such as the Consumer Cost Index (CPI). An annuity with a CPI modification will certainly start with lower payments or require a higher initial premium, however it will certainly give at least partial security from the risk of rising cost of living.

Income payments stay continuous if the investment performance (after all costs) equates to the assumed investment return (AIR) stated in the agreement. Immediate annuities typically do not permit partial withdrawals or supply for cash money abandonment benefits.

Such persons should seek insurance firms that make use of low quality underwriting and take into consideration the annuitant's health and wellness condition in figuring out annuity revenue repayments. Do you have sufficient monetary resources to meet your earnings needs without buying an annuity?

How Does An Annuity Make Money

For some alternatives, your wellness and marriage status may be considered (surrender charges on annuities). A straight life annuity will provide a higher month-to-month revenue payment for a given costs than life contingent annuity with a duration certain or refund function. To put it simply, the price of a specific income settlement (e.g., $100 monthly) will certainly be greater for a life contingent annuity with a period certain or refund attribute than for a straight life annuity

For example, an individual with a dependent partner might desire to take into consideration a joint and survivor annuity. A person worried about obtaining a minimum return on his/her annuity costs may want to take into consideration a life set option with a period certain or a refund attribute. A variable immediate annuity is usually chosen to equal rising cost of living throughout your retired life years.

A paid-up deferred annuity, also frequently referred to as a deferred revenue annuity (DIA), is an annuity agreement in which each costs payment purchases a set buck income advantage that begins on a defined day, such as a person's retired life date. variable annuity maturity date. The contracts do not maintain an account value. The costs cost for this item is much less than for a prompt annuity and it enables a person to keep control over many of his or her other assets throughout retired life, while protecting durability defense

Each exceptional settlement purchased a stream of earnings. At a worker's retirement, the earnings streams were combined. variable annuity payout calculator. The company could take full advantage of the staff member's retired life benefit if the agreement did not give for a survivor benefit or money abandonment advantage. Today, insurance companies are marketing a comparable item, usually described as longevity insurance policy.

The majority of contracts permit withdrawals below a defined degree (e.g., 10% of the account value) on a yearly basis without abandonment cost. Cash money surrenders might undergo a six-month deferment. Build-up annuities normally supply for a cash repayment in case of death before annuitization. In New york city, fatality advantages are not treated as abandonments and, as such, are not subject to surrender fees.

Table of Contents

Latest Posts

Highlighting the Key Features of Long-Term Investments Everything You Need to Know About Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvant

Breaking Down Variable Annuities Vs Fixed Annuities A Closer Look at How Retirement Planning Works What Is Annuities Fixed Vs Variable? Benefits of Choosing the Right Financial Plan Why Retirement Inc

Decoding How Investment Plans Work A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choosing the Righ

More

Latest Posts